Rate Hikes Not Enough to Cool the Philly Housing Market

In Q4 of 2022, the national housing market felt like a fast moving train with a clear destination: improved affordability. 7% rates layered on top of high prices inflated by the extraordinary demand of the previous two years had created an untenable, and ultimately unsustainable, situation. It seemed like the only direction for prices was down.

When I wrote this piece in November, we were talking about seller-funded rate buydowns, the increasing success rate of aggressively low offer strategies, and frankly, desperate sellers. The seasonal quiet of the holidays paired with challenging market conditions made for a very cold winter, indeed. I guessed that we’d see more favorable conditions for investors and cash buyers by spring or summer.

In Philly, median home prices were down 6% YoY in February. This isn’t nothing, but I believe that the timing here is an important factor; much of the decrease can be attributed to the uniquely dead winter we just experienced as consumers adjusted to the new status quo. The average contract length is 1-2 months, so real estate price data comes with a predictable delay. Based on what I’m seeing today, I’m not confident that we’ll stay in negative YoY territory when this spring’s contracts close out.

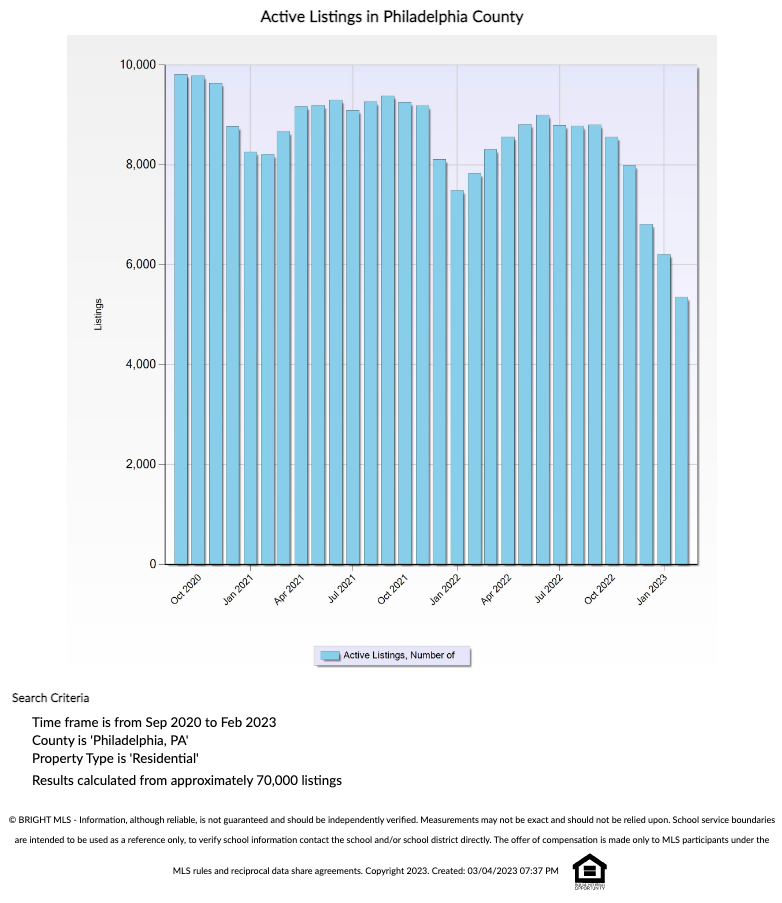

Flash forward to Q1 of 2023: we had some rate relief at the start of the year and almost found ourselves in 5-handle territory before the recent spike back to 7%, just in time for spring season. Buyers in Philly appear undeterred. Let me be clear: there are far fewer buyers right now than there were at any point since fall of 2020, but there are also even fewer quality listings for them to buy.

Generally, housing inventory increases through February as the market ramps up for spring selling season. It is now the first week of March, and we are still waiting for the inventory we so desperately need. Anecdotally, there has been some promising activity in the last week or so. Appealing listings are finally showing up for buyers of mine who have been patiently waiting since January 1st, but it’s just beginning and not as robust as it needs to be in order to absorb the considerable demand.

We’re now beginning to see some of the same sort of activity we grew weary of in 2021 and 2022, albeit on a smaller scale. Transaction volume is still a fraction of what it was, but today’s buyers are flocking to the same small handful of quality listings and driving their prices up while others sit. Bidding wars are back, temporary rate buydowns are gone for all but the most tired old listings, and lowball offers are no longer getting much traction. The market has flip-flopped on us again, and motivated buyers need to re-strategize.

The affordability relief that the Fed has been trying to create has not been effective for Philadelphia housing. 7% is feeling like interest rate limbo: too low to deter buyers, and too high to motivate homeowners to put their homes on the market and move. Lower rates would help us move some houses, but it would also flood the market with even more buyers. It seems like further rate hikes, though profoundly inconvenient for me as an agent, could be the fastest route to affordability relief for my clients. In the long run, this is what I want.

The peanut gallery on Twitter seems convinced that the housing market is crashing, but perhaps we should be even more concerned that it isn’t.

The most reasonable sounding realtor I have ever heard! I am NOT an industry professional like yourself, and you probably have a much better mix of macro and micro knowledge than I do, but I am reviewing the big picture data and making as many boots-on-the-ground observations as I can in my spare time (primarily regarding the epidemic of mortgage fraud). I'd be curious as to what you thought about a recent report on mortgage fraud out of the Philadelphia fed (shameless link to my discussion of it: https://corruptionduck.substack.com/p/what-if-1000s-of-people-were-robbing ), or any of my other random rants on mortgage fraud. I am getting the distinct feeling that we have been here before in many ways.

Grandiose predictions based on national market data 🧙♂️and the occasional self-serving snark by Twitter fancy-pants agents🧝♂️are simply SLAYED ☠️ by real-time, boots-on-the-ground observations and analysis like you have provided here. I can only imagine how grateful your clients are for having you to guide them through this “interesting” time. Great job!